Article • 9 min read

How to calculate profit margin: Calculator, formulas, and examples

Arm your business with the tools you need to boost your income with our interactive profit margin calculator and guide.

Door Hannah Wren, Staff Writer

Laatst gewijzigd December 8, 2023

The gist:

Profit margin is the percentage of income remaining after costs are deducted from sales revenue.

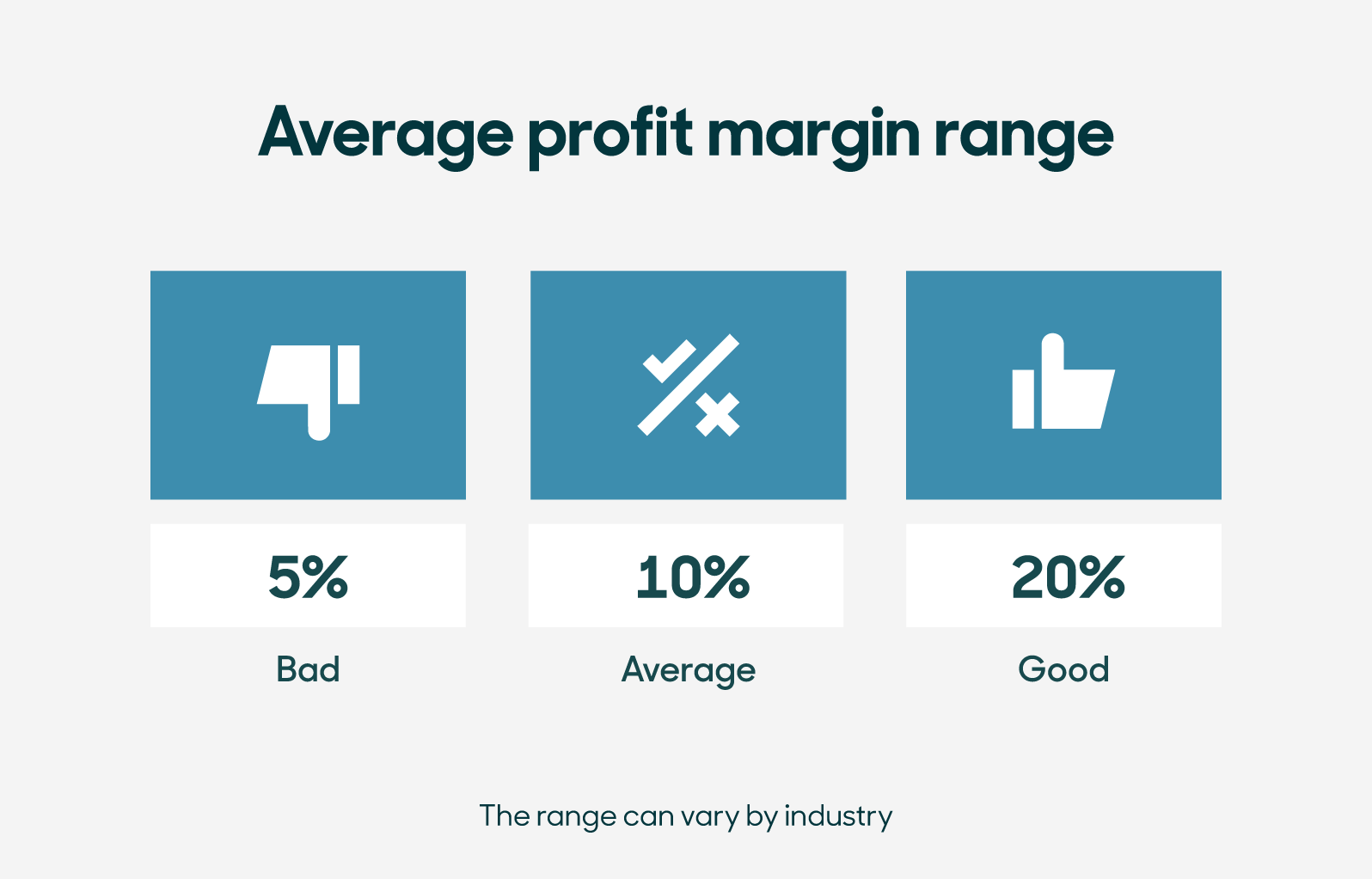

Generally speaking, a good profit margin is 10 percent but can vary across industries.

To determine gross profit margin, divide the gross profit by the total revenue for the year and then multiply by 100.

To determine net profit margin, divide the net income by the total revenue for the year and then multiply by 100.

Profitability is one of the key metrics that define the success of a company. Many small-business owners need to keep a sharp eye on their revenue and find creative ways to keep generating profit year after year. As your business grows, a reliable profit margin calculator can give you the valuable data you need to make informed financial decisions—so should your profit margins.

Our guide breaks down the details of how profit margins work, provides formulas for different types of margins, and gives real-world examples of various businesses calculating profit margins. Plus, we have a free gross profit margin calculator to help you quickly crunch your numbers.

Table of contents

Profit margin calculator

Our profit margin calculator can help you determine the selling price for your products or services so you can maximize your profit margin.

How to use this calculator:

Enter the relevant information into the data fields of the sales margin calculator, in any order.

The tool will calculate in real-time and display your results without the need to click a button.

If you make any updates, the fields will adjust accordingly.

Not all fields are mandatory.

Winstmarge calculator

Winstmarge: 0%

What is profit margin?

Profit margin is the percentage of income remaining after costs are deducted from sales revenue. The higher the number, the more profit your business generates.

Here are a few key sales terms to understand when it comes to profit margins:

- Cost: The amount of money spent to create your products or services.

- Margin: The difference between the selling price of your products or services and the costs of production.

- Revenue: The total amount of income your business generates.

- Profit: The difference between the amount earned and the amount spent to produce your goods.

Sales margin vs. gross profit margin vs. gross profit

What is the sales margin in relation to other margins? Many often use the terms sales margin and gross profit margin interchangeably, as they essentially mean the same thing. These terms are also known as contribution margin, or the percentage your business earns from a sale minus the cost of goods sold (COGS). COGS includes operational costs, labor, and materials.

Gross profit is calculated similarly but expressed as a numerical value rather than a percentage.

What is a good profit margin?

Generally speaking, a good profit margin is 10 percent but can vary across industries. Though an unwritten rule, it’s understood by businesses that profit margin ranges from five percent (bad) to 20 percent (good). Using this rule, you can quickly assess how you’re doing at a glance.

Plan your future with our free sales forecast templates

Our free sales forecast templates can help you see where your business might be in a month, year, or a decade from now. Forecasting sales also enables you to track performance, make data-driven predictions, and achieve sales goals.

How to calculate profit margins (types + formulas)

The three types of profit margins to calculate for your business include gross profit margin, operating profit margin, and net profit margin. Each is defined below and accompanied by its respective formula.

Gross profit margin formula

As mentioned above, the gross profit margin is the percentage of profit left after COGS gets subtracted from net sales.

Operating profit margin formula

Operating profit margin—or earnings before interest and taxes (EBIT)—is the ratio a company uses to show its profitability compared to its core operations. The operating profit is determined by subtracting the COGS from net sales. From there, you can plug that number into the formula below to find the operating profit margin.

Net profit margin formula

Net profit margin measures the profit percentage a business produces from its total revenue. First, you must calculate your net profit by subtracting COGS, operating expenses, interest, and taxes from your total revenue. You may then use the difference as the net profit in the formula below.

Profit margin examples

Want to put your profit percentage calculator skills to the test? Here are a few scenarios across various industries to help you practice.

Example 1: Thunderpop Sox

Thunderpop Sox is a small business on Etsy that sells pop culture socks. Each pair costs the business $3 to make, and the list price is $10 per pair. On an average day, the company sells 100 pairs of socks.

For Black Friday, Thunderpop Sox wants to offer a 20 percent discount to boost sales for the holidays. If Thunderpop sells 400 shirts at the discounted price, what will its profit margin be on Black Friday?

Example 2: Sweat’s Gym

Sweat’s Gym offers memberships for $20 per month. If the marketing and operations costs eat up 40 percent of its revenue, what is the profit margin?

Example 3: Sweetwater Pre-Owned Vehicles

Carl buys a car from Sweetwater Pre-Owned Vehicles. The original price was $20,000, and Sweetwater added a 10 percent markup. Marketing costs and labor amount to 20 percent of the original price. What is the profit margin?

How to increase your profit margin + 6 best practices

Want to boost your bottom line? Follow these best practices to increase your profit margin.

1. Streamline operations and processes

Empowering employees with streamlined operations and processes that make their jobs easier can lead to a higher profit margin. Tools that unify customer communication and data so agents don’t have to search for information can also boost efficiency and productivity. This is essential for providing a great customer experience while processing customer orders.

When a change in statewide legislation allowed for beer with a higher alcohol content to be sold in local grocery and convenience stores, Standard Beverage saw an opportunity to rapidly scale its business. With help from the easy-to-use Zendesk platform, Standard Beverage was able to keep the influx of customer information and communication organized while quickly onboarding new sales reps to hit the ground running. This led to an increase in sales revenue and higher sales margins.

2. Reduce operating costs

A great way to quickly increase profit margin is to reduce operating costs and expenses. You need to develop an effective sales plan and understand where you can effectively cut costs without hurting your business. The first step is auditing operations to identify money-saving opportunities. Some common areas include:

Unnecessary labor or staffing costs

Opportunities for automation

Expensive or unused office space

Underutilized equipment

Unused subscriptions

Vendor discounts

3. Build customer loyalty

Retaining customers and building customer loyalty are reliable ways to increase your profit margins. In fact, acquiring a new customer costs five times more than selling to an existing one. By providing excellent service, personalizing customer interactions, and offering perks like loyalty programs, you can create a dedicated customer base that consistently buys from you.

4. Increase average order value (AOV)

Another effective way to increase profit margin is to increase your average order value (AOV). Simply put, you want your customer to spend more per transaction. To calculate AOV, divide your total revenue by the number of orders.

Here are some ways to increase your AOV:

Incentivize order minimums with discounts or free shipping

Offer bundles or packages

Add recommendations or “customers also bought” prompts to online carts

Upsell or cross-sell products

UpStack is one company that uses Zendesk to unify customer information and communication in a single view rather than relying on spreadsheets and multiple programs. Since implementing Zendesk, UpStack increased visibility and saw more opportunities for upsells, doubling its revenue.

5. Prioritize high-margin products

To increase revenue and profit margins, identify which products or services sell the best and have the most potential to deliver the most profit for your business. Prioritize these high-margin products to maximize your revenue.

For services, consider your high-margin versus low-margin customers and focus more on the former. Dedicate your resources to these high-value clients so you can increase profitability.

Meal delivery service Freshly took this approach by concentrating on its higher-margin product: ready-to-eat bulk meals. The company targeted B2B sales rather than individual customers and quickly implemented Zendesk to handle its new sales pipeline.

6. Adjust your pricing

The most obvious solution may be the most effective. Some small businesses avoid raising prices, fearing that customers will jump ship. However, if you provide a quality product with great customer service, a bump in your pricing will rarely deter customers from making a purchase.